Articles

News

EVs Get a Charge Out of Aluminum-Ion Batteries

Aluminum-ion rechargeable batteries charge 10 times faster than lithium-ion batteries, recent test results show in a study by Australia-based Graphene Manufacturing Group. Although their energy density is about 60% of the energy per weight of the best lithium-ion batteries, they provide other benefits: Speedy charge. A smartphone running an aluminum-ion battery could charge fully in […]

Read MoreNOTED: The Supply Chain In Brief-Aug 2021

Good Works Global logistics services provider DHL Express delivered the U.S. government’s donation of 1 million doses of the Pfizer-BioNTech vaccine in collaboration with the COVAX global vaccine-sharing program. DHL arranged pickup of the vaccines from U.S. facilities before they were airlifted from its Cincinnati hub to the DHL Express Subang Gateway in Malaysia, where […]

Read MoreIN BRIEF: New Services & Solutions-August 2021

Products Confidex released its new Ferrowave Micro on-metal label for use on retail items such as golf clubs, cosmetics, and metallic beverage containers that were once too small for RFID tagging. With an acrylic adhesive that securely attaches to painted or non-painted metal surfaces, the label also serves as brand authentication for high-value goods. The DuraLabel […]

Read MoreE. Coli Eats Up Plastic and Churns Out Vanilla

U.K. scientists used E. coli to transform plastic waste into vanillin, the molecule responsible for the characteristic smell and taste of vanilla. This means it’s possible to transform plastic into a highly useful material for cosmetics manufacturing. Researchers used genetic engineering to create a strain of E. coli that converts one of the chemicals used […]

Read More

Fertilizer Company Launches Autonomous, Zero-Emission Vessel

In an effort to reduce its reliance on diesel trucks, Norway-based fertilizer company Yara International has developed the first autonomous, zero-emission cargo ship. The Yara Birkeland is fully autonomous in piloting as well as port operations, allowing the vessel to dock, tether, and begin the cargo transfer process on its own. Yara relies on diesel […]

Read More

Plastic Pallets Stack Up Sustainability

What’s in store for the pallet industry, and how will it affect retailers’ sustainability goals? Jeff Pepperworth, president and chief executive officer at iGPS Logistics, a national plastic pallet pooling services provider, shares his outlook. Q: What’s the state of the plastic pallet industry at the moment? Right now, the industry is robust. We see […]

Read MoreNOTED: The Supply Chain In Brief-July 2021

Green Seeds Leonard’s Express adopted a new source of alternative energy for its national fleet of long-haul diesel trucks by using the SPI Energy Reaction System. The system alters the chemistry of combustion by reusing the exhaust gases that are being wasted. To reduce pollution and noise disturbance, GEODIS invested in a green fleet for […]

Read MoreIN BRIEF: New Services & Solutions-July 2021

Technology BookYourCargo launched the Digital Drayage Platform to provide shippers with instant quotes and shipment visibility. Featuring machine learning engines, the platform integrates API/EDIs with existing third-party software platforms. Customers and vendors can search and compare rates by location, move type, and driver availability through access to a mobile device app. Shippers gain end-to-end digitization with […]

Read More

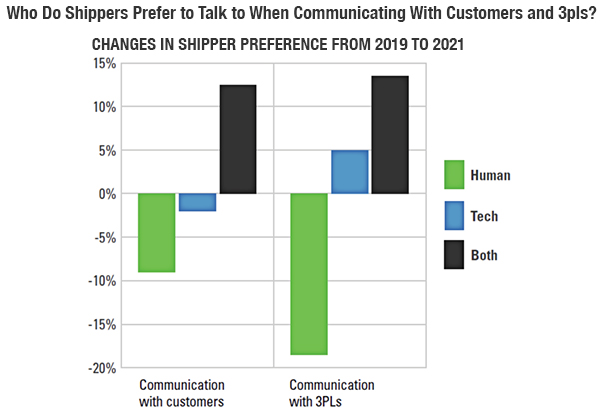

People Aren’t Going Anywhere

Although automation helps shippers meet unprecedented demand for faster and cheaper delivery, people are essential for a well-functioning network, says a Coyote Logistics report. As supply chains grow increasingly complex, technology is more efficient at sifting through large data sets in real time and running scenario analyses. However, people aren’t going anywhere (see chart). No […]

Read More

Vertical Focus | Energy, Oil & Gas

Offshore Wind Project Isn’t a Breeze President Biden recently approved the Vineyard Wind project—the first major U.S. offshore wind farm—off the coast of Massachusetts. The project, which would generate up to 800 megawatts of electricity from 62 giant wind turbines, is expected to produce enough electricity to power 400,000 businesses and homes in New England […]

Read More

Smart Clothes Hit the Rack

Will warehouse workers suit up in electronic clothing? Possibly. MIT researchers released a line of smart clothes that can track physical movement, and Fudan University researchers in China unveiled state-of-the-art electronic textiles that can produce visual displays. This is all happening as wearable devices continue to streamline supply chain operations and provide critical feedback in […]

Read More

Designers Cultivate Plant-Based Leather

Fashion designers branch out to plant-based textiles in response to growing demand for sustainable and cruelty-free products, and as supply chains seek to lower their carbon footprint. These leather alternatives are heating up: Cactus: Fast fashion company H&M is partnering with Mexico-based Desserto to create a new collection, including shoes made from cactus leather. Desserto […]

Read MoreCisco Snags Top Supply Chain Spot

Cisco Systems earned the number-one spot in Gartner’s ranking of the 2021 top 25 supply chains. The technology company’s agility and strength in environmental, social, and governance initiatives helped prioritize critical infrastructure for hospitals and vaccine research, Gartner says. Four new companies on this year’s list include Dell Technologies, Pfizer, General Mills, and Bristol Myers […]

Read More

Supplier Information Still a Concern

The pandemic revealed widespread problems with supplier information on a global scale. While many procurement leaders responding to the 2021 Supplier Information Study, commissioned by Tealbook, had initially vowed to invest in supply chain resiliency, almost a year after the pandemic they still grapple with issues surrounding poor supplier information: Agility: Nearly all respondents agree […]

Read More

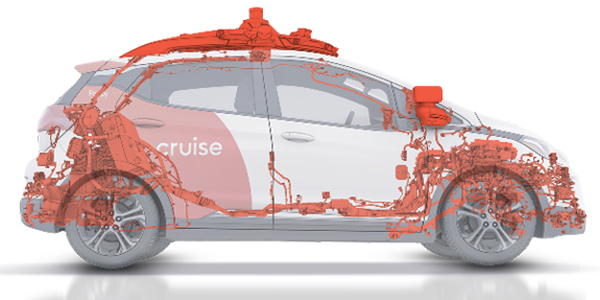

Hailing Robotaxis for Delivery

Cruise, GM’s autonomous vehicle arm, was mainly focused on launching an autonomous ridesharing service, but may use its "robotaxis" for delivery services instead. It recently added Walmart as an investor in an extended fundraising round that grew to $2.75 billion, and had completed a delivery pilot with DoorDash in San Francisco even before the pandemic. […]

Read More

Target Practices Faster Fulfillment

Instead of using carriers to ship all its online orders, Target is building its own team of dedicated delivery personnel to get packages to customers’ doors even faster, helping the retailer compete with its e-commerce rivals, says a CNBC report. The new approach involves three companies that Target acquired: Grand Junction, Deliv, and Shipt. Target […]

Read More

Amazon Delivery Drivers, Assemble!

Amazon shoppers may soon have the option to have their orders assembled upon arrival, says a Bloomberg report. The e-commerce giant is testing the premium service as online furniture and housewares sales continue to soar and shoppers get more comfortable making big-ticket purchases online. Amazon currently offers scheduled at-home delivery to a particular room, but […]

Read More

Vertical Focus | Textiles

Dawn of the Deadstock To address pandemic-induced material shortages, economic volatility, and environmental concerns, many retailers are working to make their supply chains circular. These initiatives help the cause by reviving deadstock material—unused fabric that fashion brands typically store or destroy. Here’s how some retailers are bringing their deadstock to life: Queen of Raw: This […]

Read More