Articles

Takeaways

State of Logistics Report; The Latest Data on Cross-Border Trade; Spotlight on Autonomous Supply Chains & other Logistics News

News, trends, and insights on the latest in global logistics and supply chain management.

Read More

Prepping for Peak-Season; Next-Level Yard and Dock Ops; Strategies to Mitigate Disruption; & More Supply Chain News

Get the latest supply chain and logistics insights from expert research, analysis, and trend reports.

Read More

Retail Stores as Fulfillment Hubs; Logistics Trends to Watch; Women Thrive in Manufacturing; other Supply Chain and Logistics News

Retail’s Big Shift It’s official: Retailers are no longer just merchants; they’re experts at building logistics networks. Leading retailers are transforming stores into fulfillment hubs, cutting costs while speeding delivery. That’s the consensus from Manhattan Associates’ 2025 Unified Commerce Benchmark for Specialty Retail—an analysis of 220 retailers across seven industry segments, evaluating 300+ customer experience […]

Read More

Cold Chain Automation Surges; AI Hits the Back Office; DCs Go Mega & Other Supply Chain News

What’s trending in logistics and supply chain today? Here’s a roundup of research findings that are making waves.

Read More

The State of Globalization; Combatting Cybersecurity Threats; AI for Small Manufacturers; and other Logistics News

Discover the latest insights driving the future of the global supply chain, from emerging technologies to shifting market dynamics.

Read More

Tackling Tariffs and Trade Headaches: How to Overcome Supply Chain Visibility Gaps and Global Barriers

Supply chain and logistics managers face global trade barriers and geopolitical risk and uncertainty. Here’s how to handle tariffs and prepare for supply chain disruptions.

Read More

Experts Soundoff on Tariffs; Net Zero Progress Stalls; Truck Drivers Feel Optimistic; and More Logistics & Supply Chain News

Read the latest updates on supply chain and logistics news.

Read More

Building a Future-Ready Supply Chain; Intermodal Rebounds; Strategic Shoring Gains Favor; and Other Logistics News

A look at the latest news stories in global supply chain and logistics.

Read More

Cargo Theft on the Rise; The Impact of Truck Driver Detention; and Other Logistics News

Updates and insights on the latest supply chain and logistics news stories.

Read More

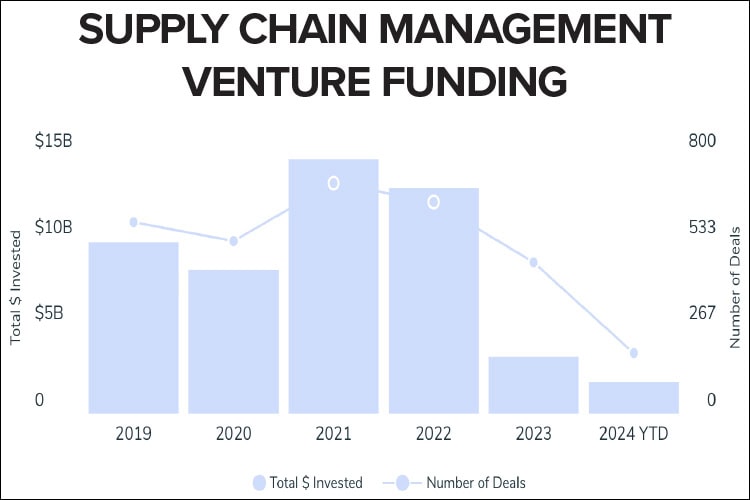

Supply Chain VC Update; What’s Next for U.S.-Mexico Trade; Regulations Roundup; and more Logistics News

A look at the latest news stories in global supply chain and logistics.

Read More

5 GenAI Trends, Freight Forecast & Other Supply Chain News

Today’s top supply chain news stories.

Read More

Ranking the Top U.S. Ports; Warehouse Taxes on the Rise; Global Trade as Election Issue; and Other News

Find out which U.S. container ports rank top for imports; see how global trade policies will impact the presidential election; and catch up on other supply chain news.

Read More

Manufacturers Are Optimistic; Truck Drivers Want Better Pay and Equipment; and Other Supply Chain News

Takeaways that are shaping the global supply chain.

Read More

Operating Regenerative Supply Chains; Tech That Attracts Workers; Cargo Theft on the Rise; and Other News

From weighing decisions that offer quick wins against those aimed at long-term gains to coping with workforce shortages, here are the latest issues and developments affecting supply chain managers.

Read More

Supply Chain Trends to Watch; Top Retail Logistics Challenges; Other News

Supply chain technology trends to watch for 2024; what are retail logistics professionals most concerned about?; the fallout from the Baltimore bridge collapse; and other logistics and supply chain news.

Read More

New Global Sourcing Hotspots & Other Logistics News

Are companies moving their supply chains away from China? Plus, reactions to the White House’s update on cybersecurity and new data on same-day delivery.

Read More

Digital Twins Gaining Ground; Intermodal Projects Get Green Light; More Supply Chain News

What’s shaping the future of the global supply chain? Digital twins, disruption mitigation, intermodal investments, and AI, among others.

Read More

Spotlight on Freight Audit & Payment: Interest is Up in Keeping Costs Down

Optimizing transportation spend is top of mind for shippers today—and the emphasis is likely to grow as companies seek ways to maximize budgets across every department. As a result, the need for freight audit and payment services is growing.

Read More

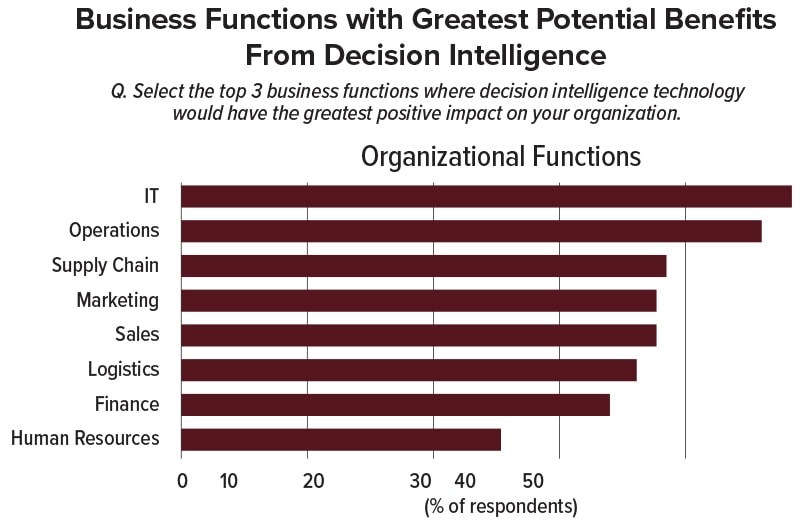

The Supply Chain Benefits of AI-Powered Decision Making

Leaders from eight countries and a range of industries were asked about the challenges and opportunities of AI-powered decision making. Here are the top takeaways.

Read More

Manufacturing CEOs Accelerating Investments in AI, Automation & Robotics

Manufacturing CEOs are making big plans for 2024, including accelerating investments in artificial intelligence, automation and robotics. Plus, other news shaping the global supply chain.

Read More